According to the World Bank's 2023 Global Payment Systems Survey, intra-African payments take an average of 3-5 business days to settle, significantly longer than same-day settlements common in developed markets. The African Development Bank reports that these delays, combined with higher transaction costs and forex charges, create substantial operational inefficiencies for businesses across the continent.

Here’s a closer look at why these delays matter and practical strategies to mitigate them for African businesses.

The Hidden Costs of Settlement Delays

When we talk about payment delays in Africa, most businesses focus on the obvious: missing money means missing opportunities. But the real story is bigger and costlier. Settlement delays trigger a chain reaction that hits four critical areas: your immediate revenue, your customer relationships, your risk profile, and your entire supply chain.

For a typical medium-sized business, these combined effects can reduce operating margins by up to 15%, turning what might seem like a simple timing issue into a serious threat to the company’s survival. Let’s look at each cost in detail.

The Real Money Lost: Beyond Processing Fees

Let's talk real numbers. When you're running a business in Africa, payment delays hit your wallet in ways you might not expect. The most obvious? Those brutal cross-border fees. The Bank for International Settlements (BIS) found African businesses are paying about 8.9% just to move money across borders. That's three times what businesses pay in most other parts of the world. Even domestic transfers sting, with processing fees eating up 1.5-3.5% of each transaction.

But here's where it gets expensive. When payments get stuck, businesses get desperate. You need to pay suppliers, make payroll, keep the lights on. So what do you do? You hit up the bank for an overdraft or scramble for a short-term loan. Those aren't cheap. Miss out on early payment discounts from suppliers? That's another 2-3% down the drain. Late payment penalties? They add up fast. Do the math on a business moving $100,000 monthly, and you're looking at losing up to 15% of your margins to these delays.

When Customers Lose Faith

Trust is everything in business, and payment delays kill trust fast. McKinsey's 2023 survey shows the damage: more than half of African consumers (54%) have dealt with payment delays. But here's the kicker - 42% of them walk away to competitors when it happens. In a market where digital payments are growing 25% every year, you can't afford to be the business that can't get payments right.

Think about it. Your customer is used to instant everything - messages, deliveries, mobile money transfers. When their payment gets stuck in your system for days, they're not thinking about bank processing times or settlement windows. They're thinking about the competitor who might do it better. In African markets, where word travels fast and trust is currency, one payment delay can cost you not just that customer, but everyone they talk to.

Understanding the Chargeback and Compliance Burden

The complexity of payment disputes in African markets creates a unique set of challenges. African Development Bank data reveals that KYC verification processes typically take 12-36 hours, significantly longer than global averages. This extended timeline, coupled with the requirement for 4-8 core documents for merchant verification, creates a complex compliance environment that can quickly spiral out of control when settlement delays occur.

When payments are delayed, the likelihood of chargebacks and disputes increases significantly. Each dispute not only incurs direct costs but also requires substantial administrative resources to resolve. For many businesses, this creates a double burden: managing the immediate financial impact while simultaneously dealing with the operational overhead of dispute resolution. The situation is further complicated by varying regulatory requirements across different African regions, making standardized dispute resolution processes challenging to implement.

The Ripple Effect Through Supply Chains

Perhaps the most far-reaching impact of settlement delays manifests in supply chain relationships. 47% of African SMEs identify payment delays as a major constraint on their operations. This statistic takes on greater significance when considering that late payments affect 63% of supplier relationships, creating a domino effect that can destabilize entire supply networks.

The working capital constraints, impacting 52% of businesses, force difficult decisions. Suppliers, facing their own cash flow pressures, often respond by tightening credit terms or requiring advance payments. This creates a vicious cycle: businesses struggling with incoming payment delays must somehow maintain outgoing payments to preserve crucial supplier relationships. The result is a precarious balancing act that can lead to stockouts, production delays, and ultimately, customer dissatisfaction.

Moreover, these supply chain disruptions can have long-lasting effects on business relationships. Suppliers may categorize businesses as high-risk clients due to payment irregularities, leading to less favorable terms in future negotiations. This can create competitive disadvantages, particularly in markets where reliable supplier relationships are crucial for business success.

Why Settlement Delays Are Prevalent in African Markets

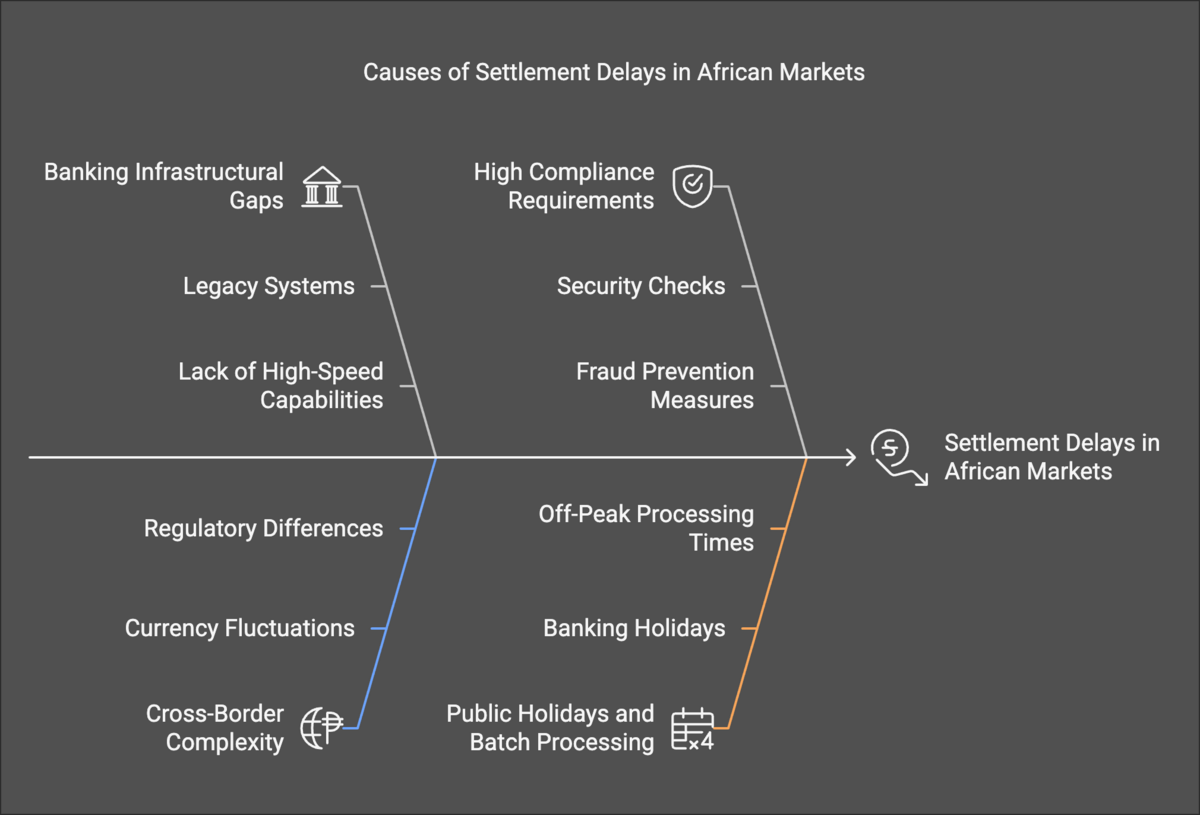

Settlement delays are often due to:

Banking Infrastructural Gaps: Many banks and payment processors in Africa operate on legacy systems not designed for high-speed, digital transactions.

Cross-Border Complexity: For businesses transacting internationally, currency fluctuations, exchange controls, and different regulatory environments slow down payments.

High Compliance Requirements: Due to fraud concerns, African financial systems often impose rigorous security checks that lengthen processing times.

Public Holidays and Batch Processing: Banking holidays and off-peak processing times can delay transactions by days in some cases.

Proactive Strategies for Managing Settlement Delays

1. Invest in Modern Payment Infrastructure

Consider switching to payment providers who offer real-time tracking, automated reconciliations, and faster settlement times. In Africa, several fintech companies specialize in quicker and more reliable cross-border transactions, which can be a game changer if you frequently work across regions.

2. Use Mobile Money and Alternative Payment Methods

Mobile money platforms like M-Pesa, MTN Mobile Money, and Airtel Money have significant reach and faster settlement times compared to traditional banking channels. Offering diverse payment methods not only speeds up settlements but can also widen your customer base, as many Africans prefer these convenient payment options.

3. Partner with Fintechs Known for High Uptime and Speed

Select payment providers with a strong track record in Africa who specialize in high uptime and smart routing to minimize delays. Fintechs that offer smart routing can automatically select the fastest and most cost-effective payment path for each transaction.

4. Be Transparent with Customers and Suppliers

Communicate proactively about any delays and offer transparency in the payment process. Providing real-time status updates for payments can build trust, and in cases where delays are unavoidable, timely communication helps manage expectations.

5. Automate and Optimize Financial Operations

Implement an automated system to quickly detect and resolve issues related to flagged transactions. Utilize platforms that integrate seamlessly with local banks and mobile money solutions, ensuring smooth cash flow management. Establish direct contacts within your banking network who can expedite processes when needed.

The Benefits of Tackling Settlement Delays

Improving your payment processing setup brings immediate and long-term benefits:

Better Cash Flow Control: Optimized settlements lead to steadier cash flow, helping you avoid costly credit lines or overdrafts.

Enhanced Customer Loyalty: Reliable payment experiences build trust and encourage customer retention, a critical factor in African markets with growing digital competition.

Reduced Dispute and Chargeback Costs: Minimizing delays can help you avoid costly chargebacks and maintain a positive relationship with payment processors.

Stronger Supplier Relationships: Prompt payments to suppliers help you avoid late fees and keep your supply chain running smoothly.

Take Control of Your Payment Infrastructure with Miden

Don't let payment delays hold your business back. Join forward-thinking businesses taking advantage of Miden's platform to transform their payment operations.