Business payments are more than a back-office process; they shape how companies grow, manage cash flow, and expand into new markets. In Nigeria and South Africa, those systems are shifting quickly.

We wanted to understand exactly how businesses are paying and getting paid, both domestically and across borders. This report focuses on two of Africa’s largest economies to see which payment methods dominate today, what’s driving (or slowing) adoption of newer tools, and where the opportunities lie for financial service providers.

While Nigeria remains a bank-transfer-first market, fintech-driven options like mobile money and virtual cards are gaining momentum. South Africa shows a more mature payments mix, where cards and SWIFT payments are already embedded in day-to-day operations.

This isn’t just about technology. The way money moves between businesses impacts trade corridors, supplier relationships, and even hiring decisions. And in both markets, that movement is undergoing a transformation.

Our Research Methodology

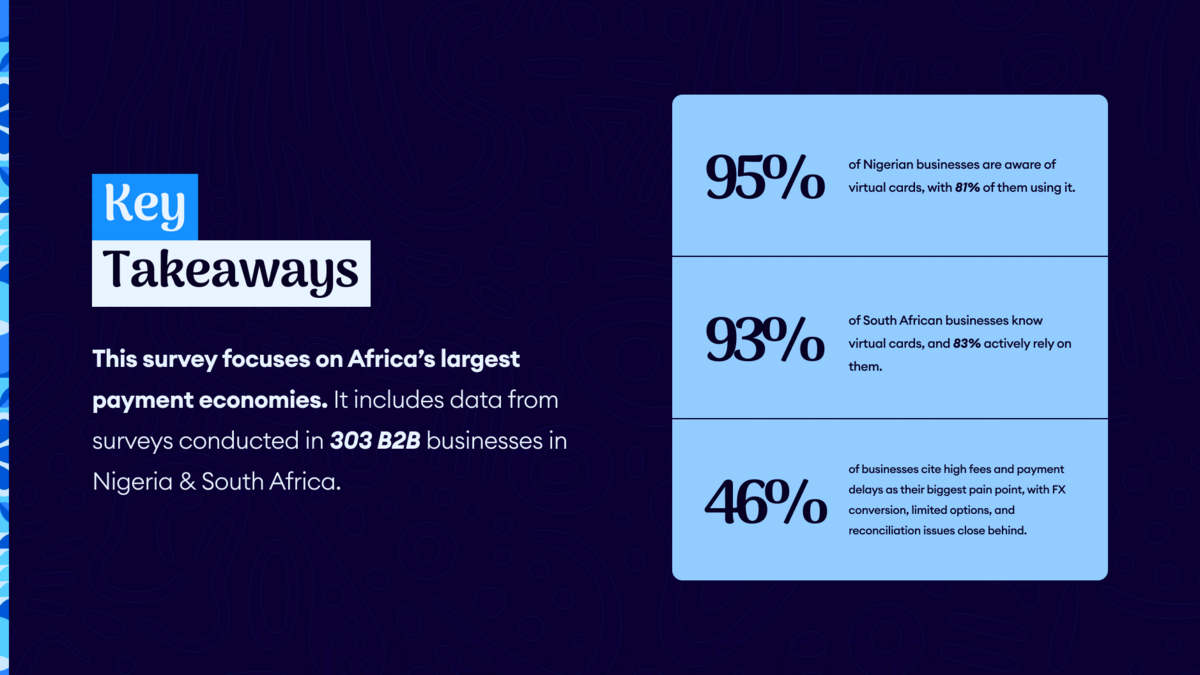

This report is based on survey responses from 303 business decision-makers — 203 in Nigeria and 100 in South Africa. Respondents represented industries including financial services, e-commerce, manufacturing, healthcare, professional services, and education.

Participants ranged from small businesses and startups to mid-sized and enterprise organizations, giving us a broad view of payment behaviors across company sizes.

The survey was conducted online between May to August. Percentages in this report have been rounded to the nearest whole number for clarity.

How Business Payments are Evolving Across Nigeria and South Africa

One shared reliance on bank transfers, two very different adoption curves.

Nigeria and South Africa may share a foundation in bank transfers, but the path toward digital-first payment stacks looks very different.

In Nigeria, bank transfers remain dominant for local B2B transactions (94% usage). Mobile money and payment gateways are gaining ground, and virtual cards have high awareness (95%) with strong adoption among those aware (81%). Businesses like their speed and transparency, but face high fees and integration barriers.

In South Africa, cards are already mainstream — 93% awareness and 83% usage — sitting alongside bank transfers (86%) and SWIFT. Here, adoption challenges center on merchant acceptance and system integration, not awareness.

Across both countries, businesses are leaning toward faster, more integrated, and more cost-efficient payment tools. Nigerian firms are testing cryptocurrency for cross-border transactions, while South African companies lean on SWIFT and cards for regional and global trade.

Looking ahead to the next 12 months:

- Expect higher card adoption for both domestic and cross-border use.

- Integration with ERP, accounting, and expense tools will be a key competitive edge.

- Fee transparency and merchant acceptance will define provider preference.

- Cross-border optimization will be a deciding factor in provider selection.

How businesses move money across borders — and where the friction is

Cross-border payments aren’t just about moving funds. For many companies, they determine how competitive you can be in new markets, how quickly you can pay suppliers, and how reliably you can get paid yourself.

We asked businesses in Nigeria and South Africa about the payment rails they use, the regions they trade with most, and the obstacles they face when sending or receiving international payments.

Nigeria: Bank transfers still lead, but mobile money and virtual cards are closing the gap

Nigerian businesses overwhelmingly rely on bank transfers for cross-border payments (81%). Mobile money (48%) and virtual cards (37%) have carved out meaningful roles, alongside payment gateways (31%) and cryptocurrency (37%) for specific corridors.

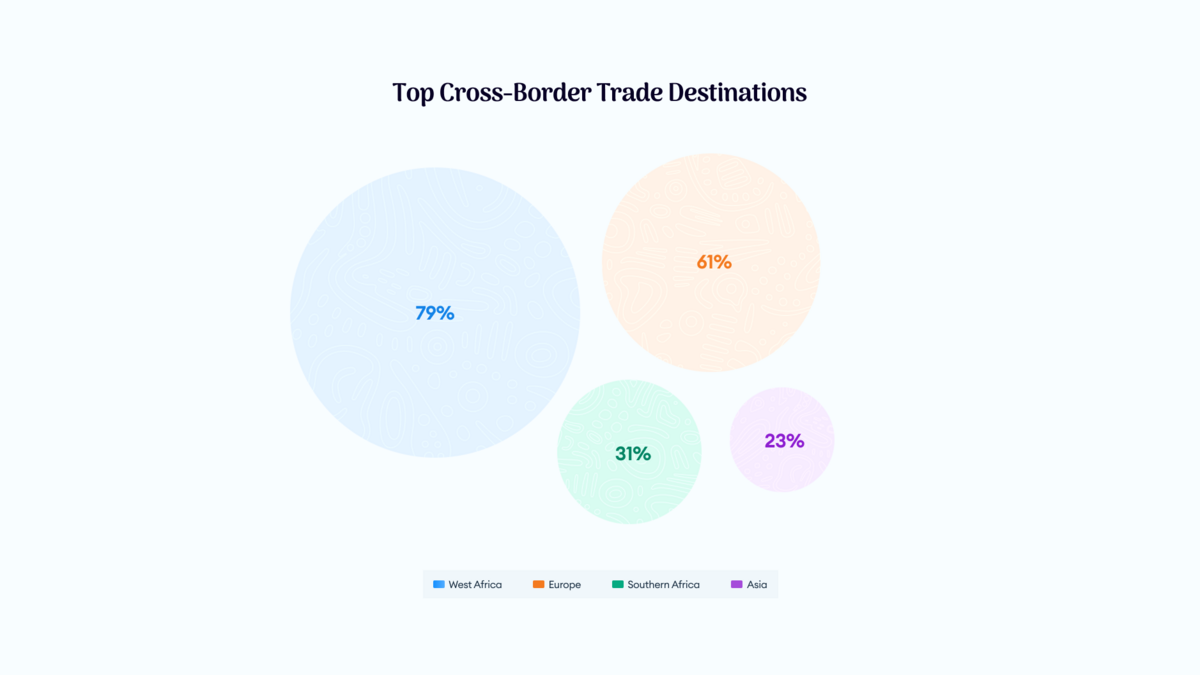

The top destinations for cross-border payments are:

West Africa — 78.57%

Europe — 61.22%

Southern Africa — 30.61%

Asia — 23.47%

The biggest pain points are high fees and delays (46.46%), followed by FX conversion (28.28%), limited payment options, and reconciliation challenges.

What this means: Nigeria’s cross-border ecosystem still runs on bank rails, but digital methods, especially mobile money and virtual cards, are gaining traction for their speed and transparency. Providers that can solve cost and FX friction stand to win market share quickly.

South Africa: Cards and SWIFT dominate a more diversified mix

South African companies take a broader approach. Cards are used by 68% of respondents, SWIFT by 57%, payment gateways by 35%, and mobile money by 34%.

A notable 82.8% of respondents have used physical and virtual cards for intra-Africa transactions. Businesses want enhanced cross-border capabilities (45%) alongside lower costs, better merchant acceptance, and improved integration with their systems.

What this means: South Africa’s cross-border setup is already multi-rail, with cards playing a central role. The opportunity lies in improving acceptance networks and making integrations with ERP and procurement systems more seamless — especially for businesses trading within Africa.

Side-by-side takeaways: Two markets, two different adoption paths

1. Nigeria: Bank transfers remain dominant, with mobile money and virtual cards in a secondary but growing role. Fees and FX issues are the main friction points.

2. South Africa: Cards and SWIFT are core to cross-border flows, and businesses are pushing for faster settlement, better acceptance, and smoother integrations.

The biggest roadblocks to smoother business payments

Adoption of new payment methods isn’t just about awareness — it’s about whether those tools fit into day-to-day operations without causing more problems than they solve.

We asked businesses in Nigeria and South Africa about the challenges they face with both domestic and cross-border payments. Their answers reveal where providers need to focus if they want to win and keep customers.

Nigeria: Reliability is the first battle to win

More than half of Nigerian businesses reported payment delays or outright failures in the past year (52%). The top culprit? Network issues — from bank system downtime and glitches during upgrades to telecom service interruptions.

Cross-border transactions add even more friction. High fees and delays (46.46%) are the most common complaints, followed by regulatory barriers, limited payment options, FX conversion challenges, and reconciliation issues.

For digital and card-based rails, businesses want lower costs, better merchant acceptance, and integrations that work seamlessly with their accounting and expense tools. Transparency and better cross-border capabilities also make the wish list.

What this means: In Nigeria, payment reliability is as important as speed. Providers who can deliver consistent uptime while tackling high cross-border costs will have an edge. Integration with core business tools will be a deciding factor in long-term adoption.

South Africa: Integration challenges are slowing adoption

In South Africa, the top complaint isn’t reliability — it’s fit. Companies most often struggle with technical integration issues and merchant acceptance gaps. Fees and regulatory constraints follow, with about a quarter of businesses also finding cross-border usage cumbersome.

When asked what they wanted most from payment providers, South African businesses called out three things: better integrations, broader acceptance, and lower costs. Many also want stronger cross-border capabilities built into the products they already use.

What this means: For South African businesses, the payment challenge is about how easily a tool plugs into existing processes. Providers who can expand acceptance networks and offer integration-ready solutions will be well-positioned to increase market share.

Shared pain points across both markets

- Costs remain a barrier to broader digital payment adoption.

- Integration with existing tools is often clunky or incomplete.

- Merchant acceptance gaps create real-world usability issues.

- Cross-border transactions need faster settlement and better FX handling.

- Businesses want clearer reporting and greater transparency.

Where payment providers can win in the next 12 months

Shifts in payment behavior don’t happen overnight, but when they do gain momentum, the winners are usually providers who saw the change coming and built for it early.

We asked Nigerian and South African businesses what they want most from their payment tools. The responses point to clear opportunities for product innovation, cost optimization, and deeper integration.

Nigeria: Lower costs, stronger integrations, and more cross-border muscle

For Nigerian companies, reducing transaction costs is the top priority. But it’s not the only one. Businesses want payment tools that fit neatly into their ERP, accounting, and expense management systems without creating manual workarounds.

Cross-border capabilities are another must-have. Faster settlement, better FX handling, and more payment options for global suppliers and partners would remove a major barrier to growth.

What this means: The winning formula in Nigeria will combine reliability, cost efficiency, and system integration. Providers who can deliver all three will have a strong case for replacing existing payment rails.

South Africa: Make payments easier to use — and easier to connect

In South Africa, the biggest opportunity is to make payments more plug-and-play. Businesses want better technical integrations, stronger merchant acceptance, and faster settlement, particularly for cross-border payments within Africa.

Lower fees and greater transparency also rank high. With virtual cards already widely adopted, the focus now is on making them, and other digital tools, work more seamlessly across different business contexts.

What this means: South Africa’s payment market is mature, but still has room for growth. Providers who simplify integrations, improve acceptance, and deliver transparent pricing will stand out in a crowded field.

12-month outlook: What to watch next

1. Virtual cards will continue to gain traction in both markets, with Nigeria playing catch-up to South Africa’s adoption rates.

2. Cross-border optimization — faster settlement, lower fees, and better FX handling — will be a priority across industries.

3. Integration-first products will have the edge, as businesses increasingly expect payment tools to work within their existing systems.

4. Merchant acceptance expansion will determine how useful new rails actually become in daily business.

5. Cost transparency will influence provider switching decisions more than brand recognition alone.

About

Miden is building the future of business payments in emerging markets. Our solutions help companies send, receive, and manage money faster, more securely, and more transparently, whether they’re paying a local supplier or a partner halfway across the world.

We work with businesses across industries to streamline operations, reduce costs, and unlock new growth opportunities. Learn more at Miden.co

Found in:

Original Reports